GST Council Unveils Phased Tax Changes, New Refund System & Appellate Tribunal Launch

1 min read

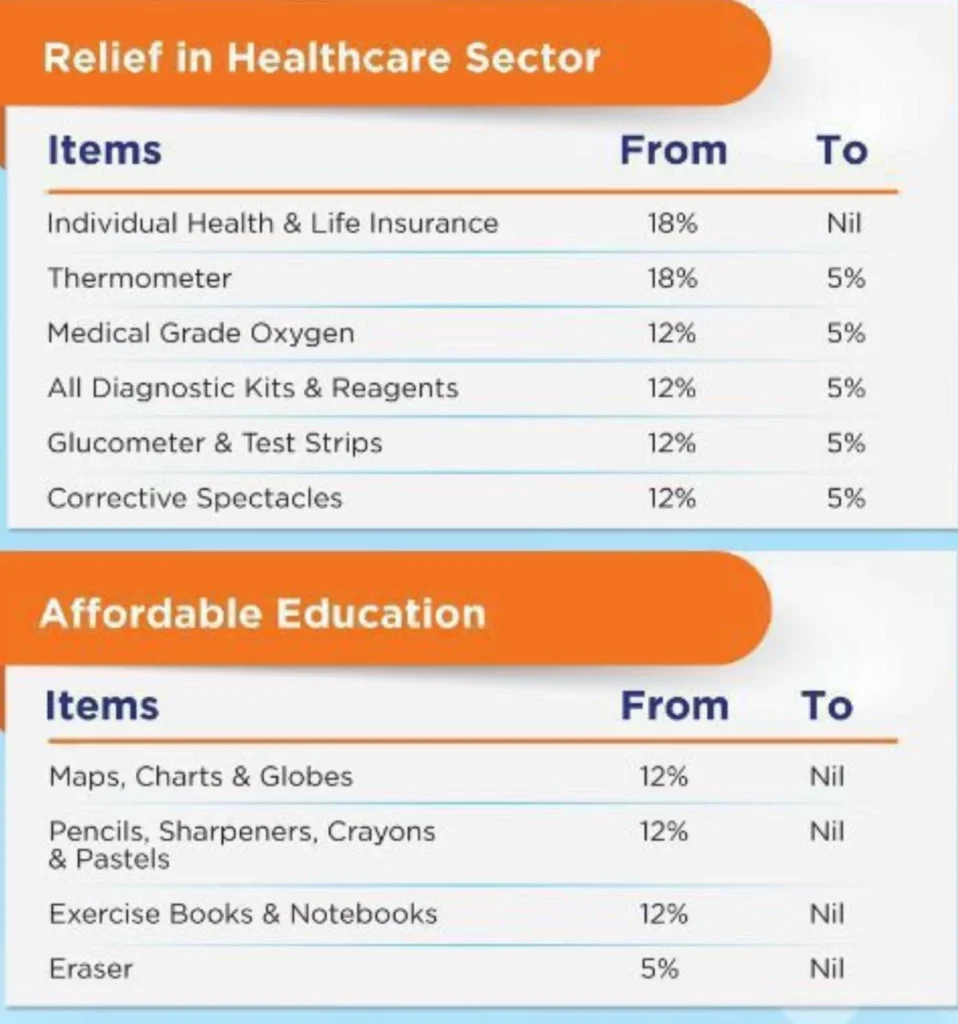

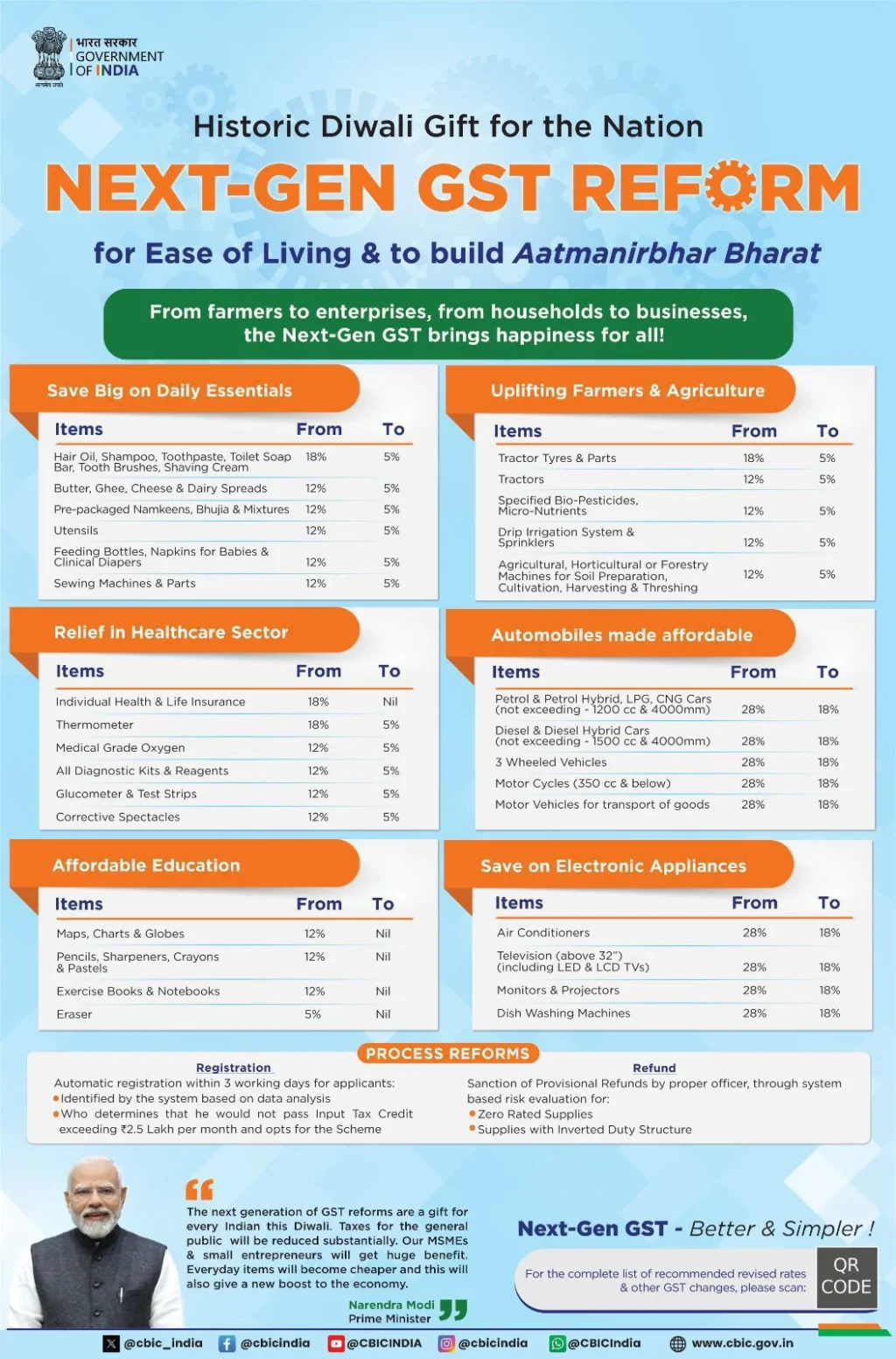

New Delhi, Sept 04: The 56th GST Council, chaired by Union Finance Minister Nirmala Sitharaman at Sushma Swaraj Bhavan, recommended significant changes in GST rates and facilitation measures.

Key highlights include:

- GST on Goods: RSP-based levy for pan masala, gutkha, cigarettes, and chewing tobacco. Ad hoc IGST & cess exemption granted on an armoured sedan imported for the President’s Secretariat.

- GST on Services: Clarification on “specified premises” for restaurants, alignment of valuation rules for lottery tickets.

- Implementation Dates: Rate changes for services and most goods effective Sept 22, 2025. Tobacco products to continue at existing rates until cess obligations are discharged.

- Refunds: CBIC to begin risk-based provisional refunds (90%) under inverted duty structure.

- Trade Facilitation: GSTAT to become operational for appeals by September-end, hearings from December, with June 30, 2026 set as the limitation date for backlog appeals.

The Council noted these reforms will enhance transparency, ensure consistency in rulings, and improve ease of doing business under GST.